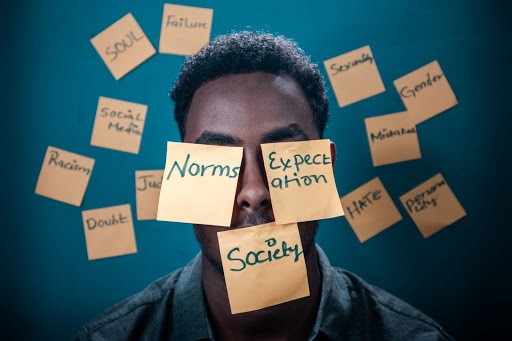

There seems to be a social bias around “borrowing” and taking credit. It is frowned upon to be seen as someone who is owing or a debtor; it is something like a stigma. In the same vein, there seems to be a knowledge gap about how to obtain credit. This is because not enough groundwork has been done to educate and sensitize people about the process and its advantages. We are largely a victim of our own system. But we can break out only if we are able to see benefits to a credits system …...

Sample research has shown that most people are averse to taking loans. People see it as being embarrassing and something that is just “hanging over” their heads. It is simply a lot of pressure for some people to handle, especially in this current financial and economic climate.

But do you know that this is the best time to take out a loan? Here’s why:

Improving living Standards — I am sure you would agree that 2020 taught us so much. We saw how life could change in an instant, with the emergence of the pandemic, and life as we know it has not remained the same. Therefore, we should take whatever opportunity to make our lives better. Whether it is financing necessities such as a house, educating ourselves/children, taking a loan can significantly improve the quality of our lives. The future is bright and can come sooner if we take the bold step.

Scaling businesses- There is hardly any business that can grow without finance. It may be easy to set up initially without much capital, but for a business to scale, it needs funds. In most modern economies of today, Governments recognize the importance of small and medium businesses to the health of the country, and therefore set aside funds to help these businesses especially. Access to funds through private alternatives at low interests without collateral is also possible. This is because of an existing social credit system that enables the financial institution to have a background credit rating/score for the individuals or businesses.

Credit Worthiness- Sometimes, even if you can afford to buy an asset, it makes some sense to take out small loans to build up a credit history. This may come in handy in the future and it is forward-thinking to have such a record before the need arises. Credit history is useful for taking out future loans, especially of significant amounts, guarantor standing for an individual, or obtaining a credit card.

In most Western countries, such as the United States, the loan economy is encouraged through student loans, mobile phone contracts, mortgages, and access to credit cards. China experienced unprecedented economic development through a social credit system — which enabled more people seemingly below the poverty line to access credits.

Here in Africa, most countries have various offline and online lending platforms, which are focused on bridging the financial inclusion gap. An interesting aspect of the lending climate is asset financing which gives the low-income earners access to affordable technology products they otherwise would never be able to afford.

For instance, M-Kopa is an African connected asset financing platform that provides underbanked customers in Africa with essential products including solar lighting, televisions, fridges, smartphones & financial services. It is based in Nairobi, Kenya. Jufopay is a fast-rising online lending platform that is positioned to serve the unbanked/underbanked in the more rural areas of Nigeria.

While we have outlined some of the benefits of taking credit, it is important to note that due diligence is required of anyone who is considering taking a loan. In fact, not everyone should take out a loan. Before applying for credit, you should carry out proper research on the loan platform you are interested in, the interest to be paid, and ensure it fits the exact purpose for which you need the loan facility. Also, consider your ability to pay back. It is very important to have a solid repayment plan as there are consequences for defaulting on loan payments.